Imagine you’re navigating through a bustling city during rush hour, trying to find the fastest route to your destination. Previously, you might have relied solely on your intuition or consulted a static map, often leading to unexpected delays and frustrations. However, with the appearance of AI-powered navigation apps like Google Maps, your journey becomes significantly smoother and more efficient, right?

Similarly, in FinTech, people are faced with navigating complex financial situations filled with various options and decisions. Just as Google Maps uses AI to analyze real-time traffic data and provide personalized route recommendations, FinTech companies leverage AI to analyze vast amounts of financial data and deliver tailored recommendations and services to their customers.

According to the most recent report, 85% of financial technology companies have already improved their financial software using artificial intelligence and machine learning technologies to deliver reliable and secure services. Besides, studies indicate that approximately 43% of financial service providers use ML algorithms for sophisticated data analysis. So, why did they implement AI, and how does generative AI affect financial services? What are the benefits of Gen AI in banking? And what are the challenges of generative AI in banking? Let’s explore all of these together in the article below!

Understanding Generative AI

But, first and foremost, let’s understand what generative AI(Gen AI) is in FinTech and what types of Gen AI techniques are relevant to FinTech.

Generative AI in FinTech refers to applying AI techniques that focus on creating new data or content rather than just analyzing existing data or making predictions based on it. In the context of FinTech, generative AI algorithms are used to generate synthetic data, simulate financial scenarios, or create personalized customer recommendations.

Types of Generative AI

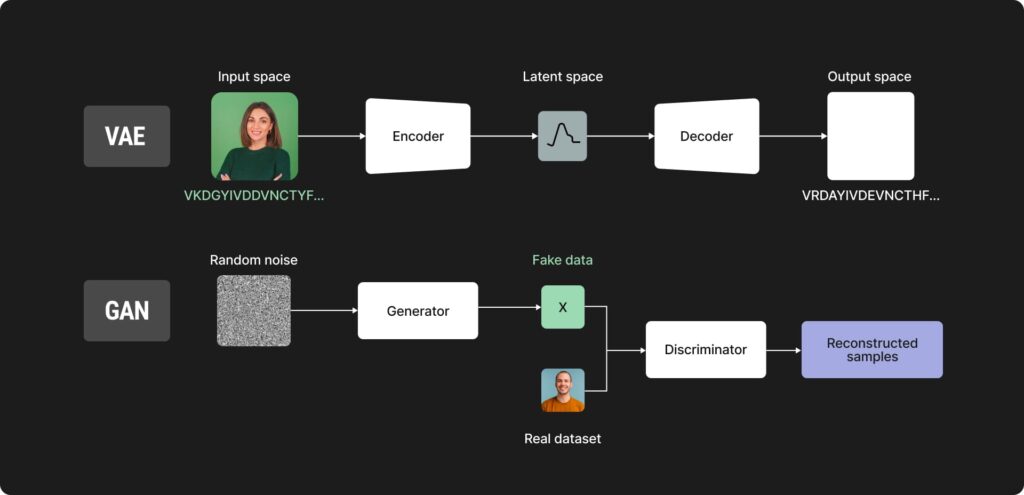

FinTech has 2 primary types of generative AI models: Generative Adversarial Networks (GANs) and Variational Autoencoders (VAEs). They are used in various ways within FinTech.

GANs

GANs operate through an adversarial framework consisting of 2 neural networks: a generator and a discriminator. The generator aims to produce synthetic data samples that closely resemble real data while the discriminator learns to distinguish between real and fake data. This competitive process drives the generator to continuously improve its ability to generate realistic data, resulting in high-quality synthetic samples. However, GANs do not explicitly define a latent space representation and rely solely on the discriminator’s feedback to guide the generator’s training.

VAEs

In contrast, VAEs adopt a probabilistic approach to generative modeling. They consist of an encoder network that maps input data to a latent space distribution and a decoder network that reconstructs the input data from samples in this latent space. VAEs aim to learn the underlying probability distribution of the input data, allowing for the generation of new samples by sampling from the learned distribution. Unlike GANs, VAEs explicitly define a latent space representation and optimize the model to reconstruct the input data while regularizing the latent space distribution to follow a predefined distribution, typically a Gaussian distribution.

How is generative AI used in banking?

Now that we understand the whole concept, let’s see how to use generative AI in banking and how does generative AI affect financial services?

The adoption of AI in businesses is increasing steadily, with its incorporation into everyday tasks becoming more commonplace. In 2021, the global market for using AI in FinTech was worth $9.45 billion. Now, experts predict that this market will keep growing at a rate of 16.5% every year from 2022 to 2030.

The global market for AI in Fintech keeps growing due to its ability to improve efficiency, improve customer experiences, mitigate risks, ensure regulatory compliance, and stay competitive in an increasingly data-driven financial landscape.

In general, Gen AI offers many solutions to FinTech. Let’s take a look at some of them:

Fraud detection

Did you know that globally, banks experience approximately 5% of their annual profits impacted by fraudulent activities? Such factors result in 90% of all bank users being really scared about potential financial fraud. Thus, banks critically need robust fraud detection and prevention measures in the banking sector. Exactly to address these challenges, FinTech companies and banks use AI to detect and prevent fraudulent activities during online and mobile banking transactions.

Customer service

Gen AI is used to create AI-powered chatbots that can provide automated customer support, respond to inquiries, resolve issues, and offer financial advice in a timely and efficient manner. For example, Bank of America has an AI-driven virtual assistant, Erica, which helps customers in various banking activities, from checking account balances to receiving financial advice.

Process automation

AI streamlines operations in financial institutions by automating repetitive tasks like loan processing, compliance checks, and regulatory reporting. Of course, it brings improved efficiency and cost reduction. For example, DBS Bank has implemented “Intelligent Banking,” leveraging over 100 AI and ML algorithms to serve 5 million retail and wealth customers across their regional markets through 45 million monthly hyper-personalized communications, offering bespoke product recommendations and improving customer experiences.

Benefits & challenges of gen AI in FinTech

On the one hand, AI offers exceptional opportunities for improving efficiency and customer experiences while mitigating risks within the financial sector. However, alongside any benefits always come challenges. In the case of AI in Fintech, it can be data privacy concerns or the potential for algorithmic biases. Let’s check out the benefits and challenges of generative AI in FinTech below.

Benefits of Gen AI in FinTech

- Improved security: As it was mentioned before in our article, generative AI offers robust fraud detection and prevention systems, helping financial institutions safeguard against fraudulent activities and security breaches. For example, with the assistance of AI, JPMorgan achieved a 15-20% reduction in instances of fraud through the lowering of account validation rejection rates.

- Personalized customer experiences: Each of us wants to be special and get a personalized experience. This results in customer satisfaction, retention, and loyalty. Therefore, gen AI creates customized recommendations and services for bank users by analyzing customer data and creating chatbots. For example, Bank of America’s chatbot Erica (which was mentioned above) or DBS’ Joy offer personalized financial guidance, help customers manage their finances, and provide tailored recommendations based on individual banking behaviors and goals.

- Efficient operations: Gen AI automates various tasks and processes within financial institutions, increasing operational efficiency and cost savings. For instance, OmniAI, a platform developed by J.P. Morgan Chase, accelerates operations by streamlining data access and computes processes for data scientists, allowing faster AI deployment at scale while its cloud-based infrastructure ensures operational flexibility, further enhancing efficiency.

- Risk management: There are a lot of risks in the FinTech industry – credit risk, operational risk, liquidity risk, and compliance risk, etc. By generating synthetic data and simulating various scenarios, gen AI facilitates better risk assessment and management, allowing for more informed decision-making. For example, banks like Deutsche Bank and Barclays leverage AI across their operations, using AI for risk management.

- Compliance and regulatory compliance: Money laundering presents a significant global challenge, with estimates indicating that between 2 and 5% of global GDP, totaling between EUR 715 billion and 1.87 trillion annually, is laundered. In combating this issue, Gen AI assists financial institutions in adhering to compliance and regulatory requirements such as GDPR, CCPA, and financial rules like KYC (Know Your Customer) and AML (Anti-Money Laundering).

One real-world example demonstrating the importance of KYC in combating money laundering involves a cryptocurrency exchange. In this scenario, individuals may attempt to create multiple accounts using different identities or false information to disguise their illicit activities, such as laundering proceeds from illegal transactions.

In this case, AI improves KYC by automating identity verification and detecting potential money laundering through analysis of data patterns, thus improving accuracy and efficiency in detecting illicit financial activities.

Without a robust KYC system in place, individuals like this may slip through undetected, laundering money obtained from illegal activities.

Challenges of generative AI in FinTech

Data privacy and breaches

Since FinTech deals with highly sensitive data, data privacy and security have become a paramount concern. Unfortunately, statistics are sad: the escalating trend of ransomware attacks on financial services, with incidents increasing from 55% in 2022 to 64% in 2023, nearly double the 34% reported in 2021, makes bank users worry about the security of their financial information.

How does generative AI in financial services introduce security risks such as data breaches or leaks? If the AI model or the generated datasets are compromised, malicious actors could exploit the information for fraudulent activities or identity theft.

Besides, if a Gen AI model is trained on real financial data to generate synthetic datasets for testing or research purposes, there’s a risk of inadvertently exposing sensitive information. Even if the generated data is anonymized, it may still be possible to re-identify individuals through techniques like data linkage or inference, posing a threat to privacy.

The lack of transparency

Nobody still knows how AI makes decisions. AI doesn’t explain it too 🙂 Without clear visibility into how AI algorithms make decisions or interpret financial data, users and regulators may struggle to understand the rationale behind certain recommendations or outcomes.

For instance, a Fintech company using AI for credit scoring may provide borrowers with approval or denial decisions without transparently disclosing the factors considered or the weight assigned to each variable. This lack of transparency undermines trust in AI-powered Fintech solutions and raises concerns about fairness, accountability, and potential biases in algorithmic decision-making.

Future outlook

How will generative AI affect banks in the near future, and what are the predictions of experts?

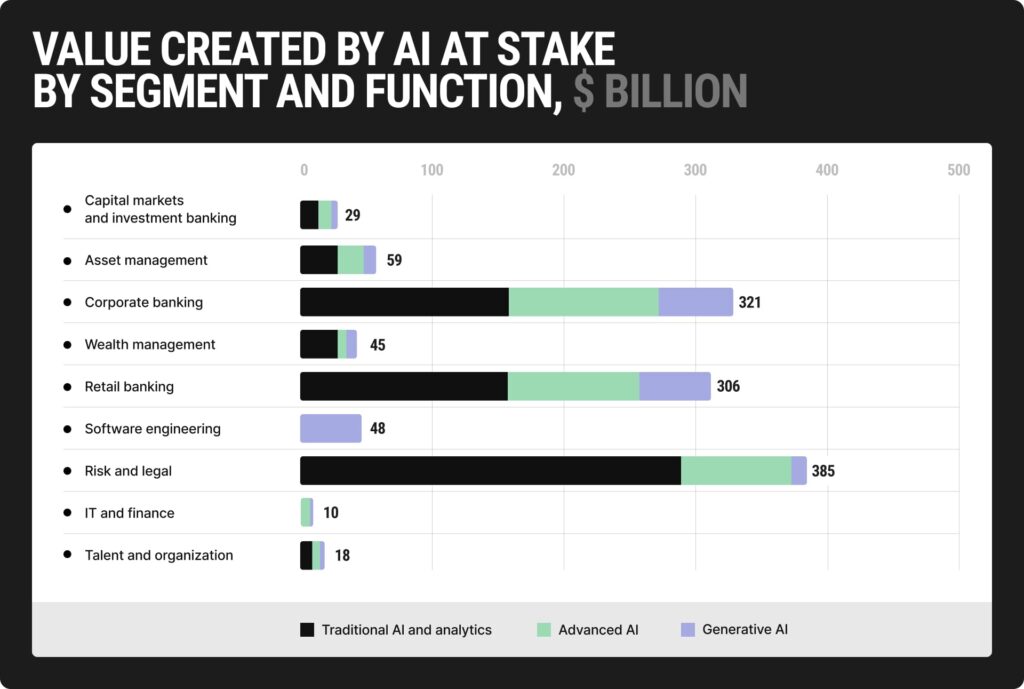

According to McKinsey & Company, general AI is poised to revolutionize the banking sector, potentially adding $200 billion to $340 billion annually in value, primarily through increased productivity.

AI technologies are expected to improve efficiency, enhance customer experiences, mitigate risks, ensure regulatory compliance, and drive innovation. As AI algorithms become more sophisticated and data-driven, they will enable financial institutions to make better decisions, personalize services, detect fraud more effectively, and streamline operations. However, challenges such as data privacy concerns and the lack of transparency remain important considerations for the widespread adoption and successful integration of AI in FinTech.

Nevertheless, we believe the last problem will soon be solved as researchers are exploring ways to improve the transparency and interpretability of AI algorithms. One approach is to develop “explainable AI,” which focuses on designing AI algorithms that can provide clear explanations for their decisions. For instance, if an AI model is used to determine a borrower’s creditworthiness, explainable AI techniques can provide transparency by explaining which factors influenced the decision, such as income level, credit history, employment status, and debt-to-income ratio.

Despite these challenges, gen AI holds immense promise for creating measurable value and transforming banking operations in the long term.