Digital Lender Lulalend Uses $6.5M Series A to the Fullest with KITRUM

Lulalend

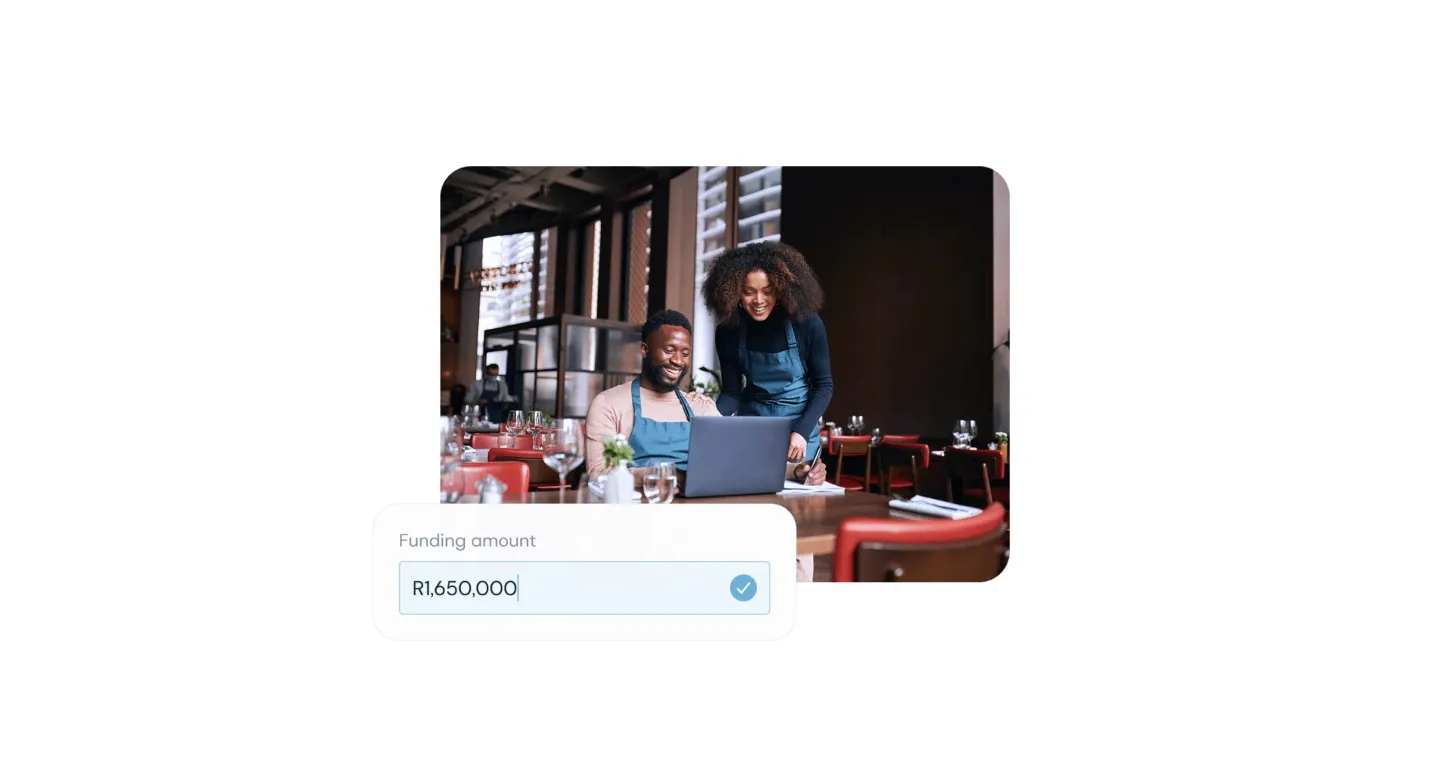

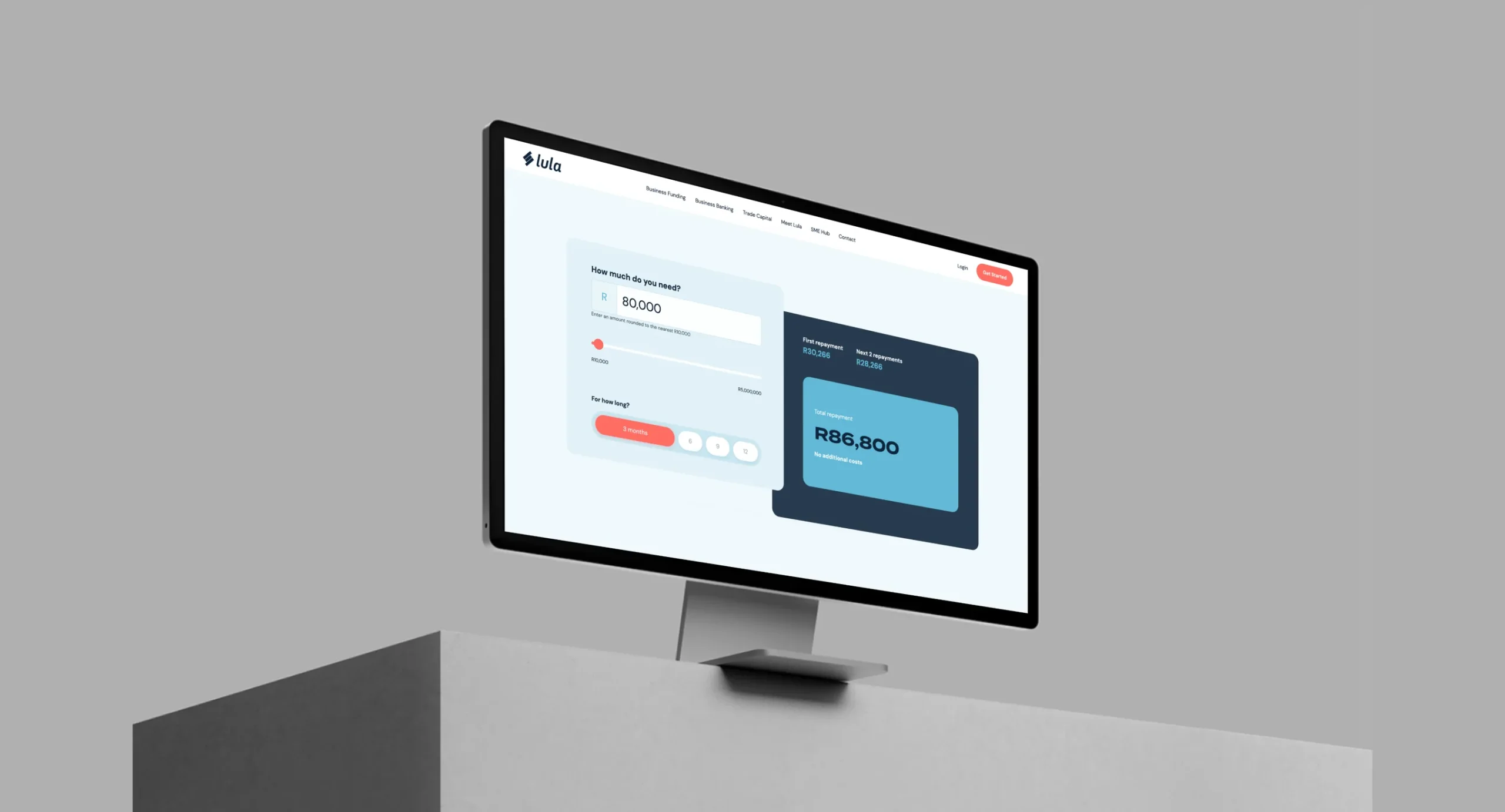

In 2014, Trevor Gosling and Neil Welman set out to give South African SMEs access to working capital to help their businesses grow. The Cape Town duo created an online application form and used algorithms to provide loans without visiting a bank branch. And after all their hard work and a $6.5M Series A, they wanted to expand their tech and data team and improve their ability to reach more SMEs in South Africa and beyond.

Neil reached out to us in the fall of 2021 with the idea of launching the next iteration of Lulalend. Instead of just processing microloans, the team wanted to reinvent Lulalend as an automated banking app with unique business logic.

Kitrum had to align itself with Lulalend’s roadmap, do a ton of research, and ensure the new app provides better banking and lending services with an architecture that allows for scaling locally and globally.

Solution

We were excited to start, but we also knew that the complex business logic and multiple integrations could lead to costly pitfalls. And from experience, we know that the only way to avoid delays and provide predictable delivery is to do our due diligence — lots of research.

To deliver a unique, scalable fintech platform, KITRUM used agile teams, an enterprise-level tech stack (.NET, React, Microsoft Azure), and layered architecture, which combines the benefits of the monolith, microservices, and serverless architectures. This approach gives the platform flexibility and scalability, enabling us to build faster to meet business objectives.

Features

- Accessing and processing credit requests

- Bank account access and prepaid card management

- Multiple account types, including freemium and premium

- Compatibility with other local payment types

- Sub-accounts for budgeting, provisioning, and other purposes

- Local and international card transactions are supported (purchase, withdrawal, etc.)

- Accounting software compatibility

Third-party apps

Third-party integrations gave us the most trouble because we ran into incomplete documentation and unexpected bugs. Thankfully, we factored in these risks early on and launched on time and within budget.

Impact

What we have achieved with the success of this project includes; account and credit management, analytics, and a funding system. We transformed an idea into a minimum viable product (MVP) in just seven months and helped launch the new Lulalend platform. The way we handled the project and built the platform has laid the groundwork for scaling processes and allowing Lulalend to disrupt banking for SMEs.

Next Chapter

Lulalend is moving full steam ahead in growing its customer base, expanding its team, and working on new features. The features and integrations in development will reduce cash flow stress for SMEs and allow small and medium businesses in South Africa to flourish.

Apart from developing new features and supporting the new platform, KITRUM is in talks with Lulalend for a possible mobile/web app in the future.

"KITRUM has a really confident project manager who came through with a very professional and cleanly structured process."