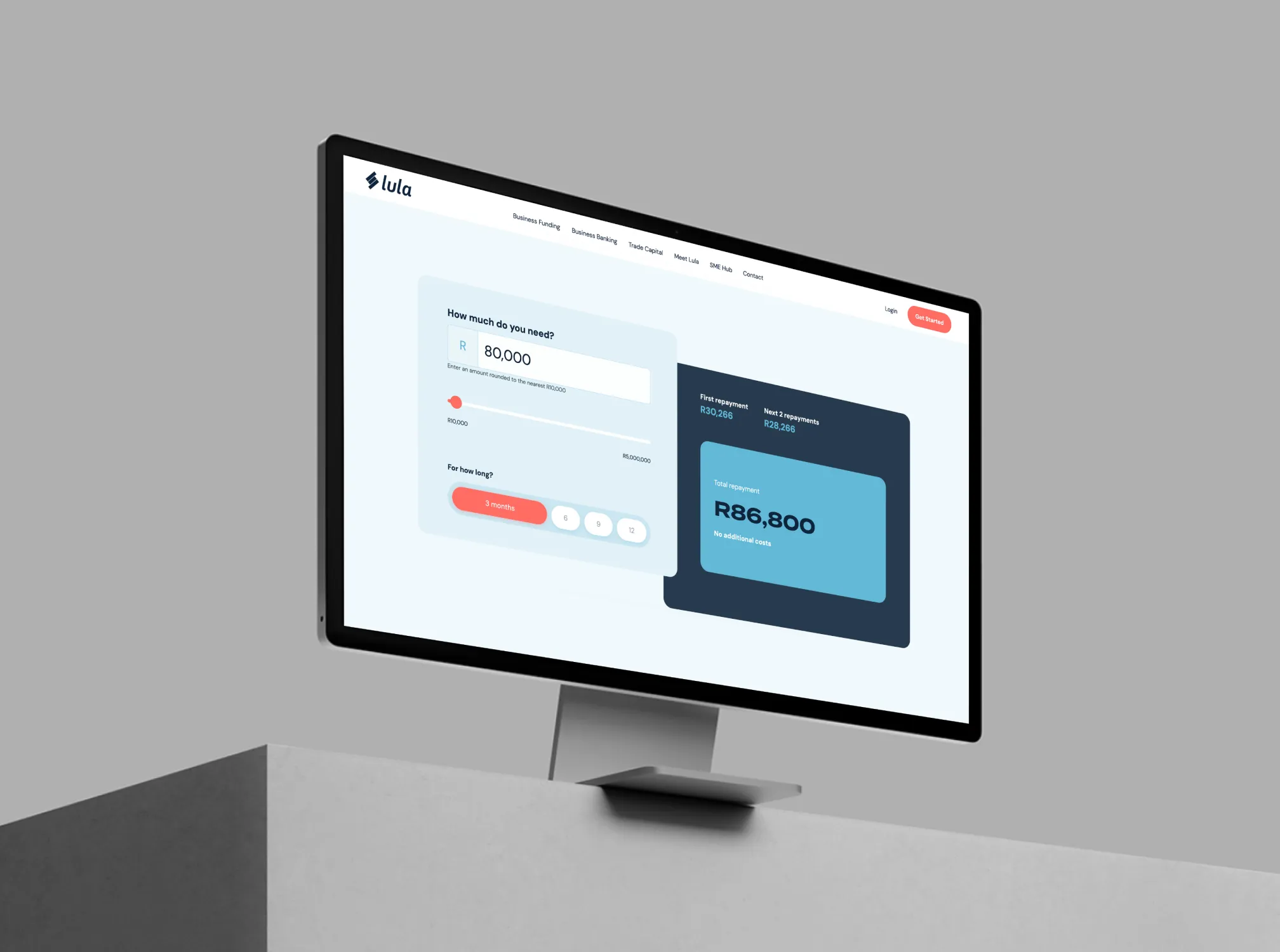

Embedded banking solution for FinTech Cross-Platform Startup

Under NDA

Our client is a platform revolutionizing banking by seamlessly integrating financial services into customers’ daily routines, providing real-time solutions in their everyday lives. The company aims to transform the traditional industry with innovative technology and a customer-centric approach. It is dedicated to elevating banking experiences and improving customers’ economic well-being.

Banks are battling to remain relevant as they face an unprecedented competitive environment and changing consumer expectations for instantaneous, highly efficient, and seamless financial experiences. In a time when consumers expect to access services from any channel at any time, our client is helping banks improve their user experience and boost their brand engagement by enabling their customers to access financial services from any mobile application.

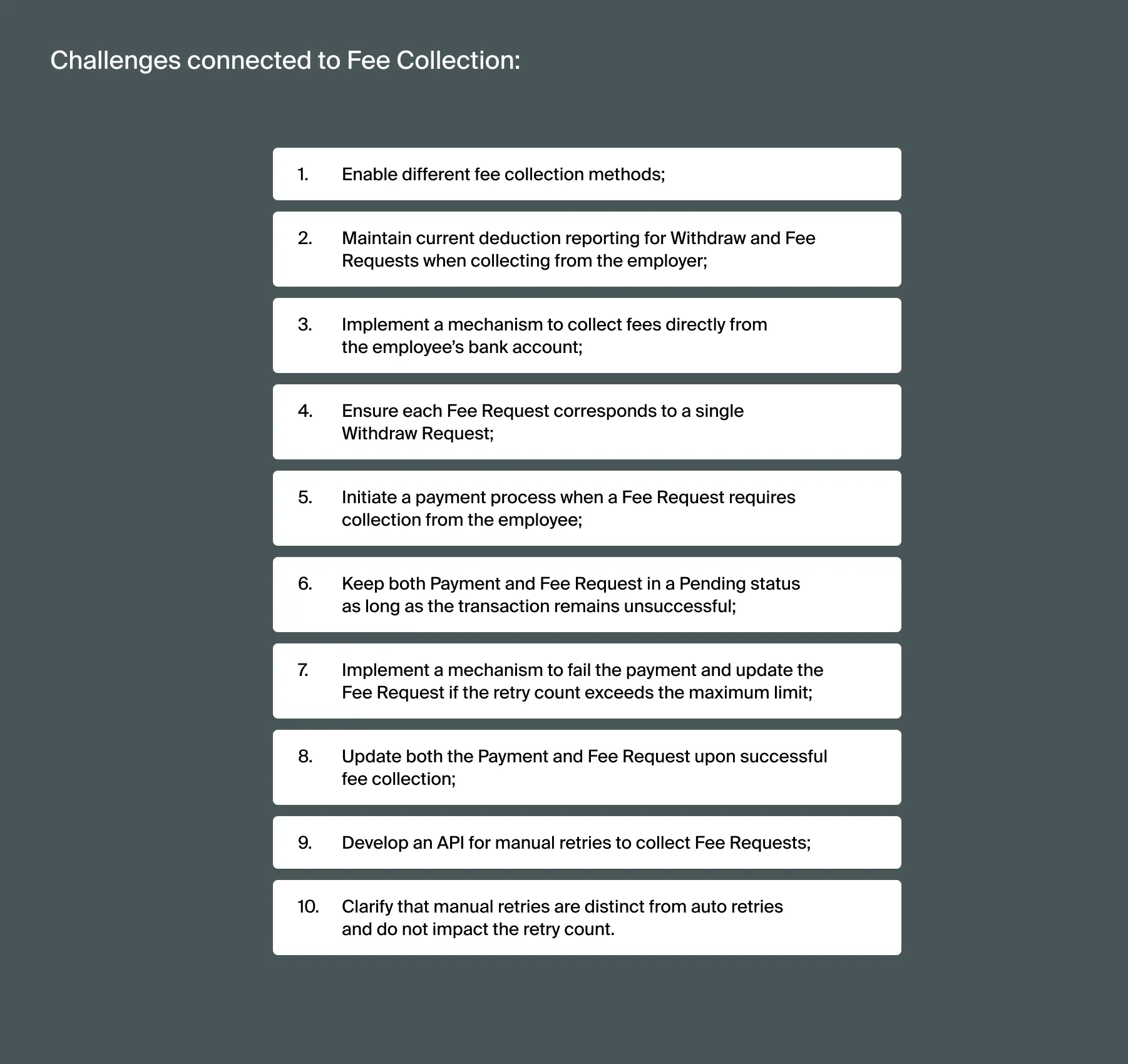

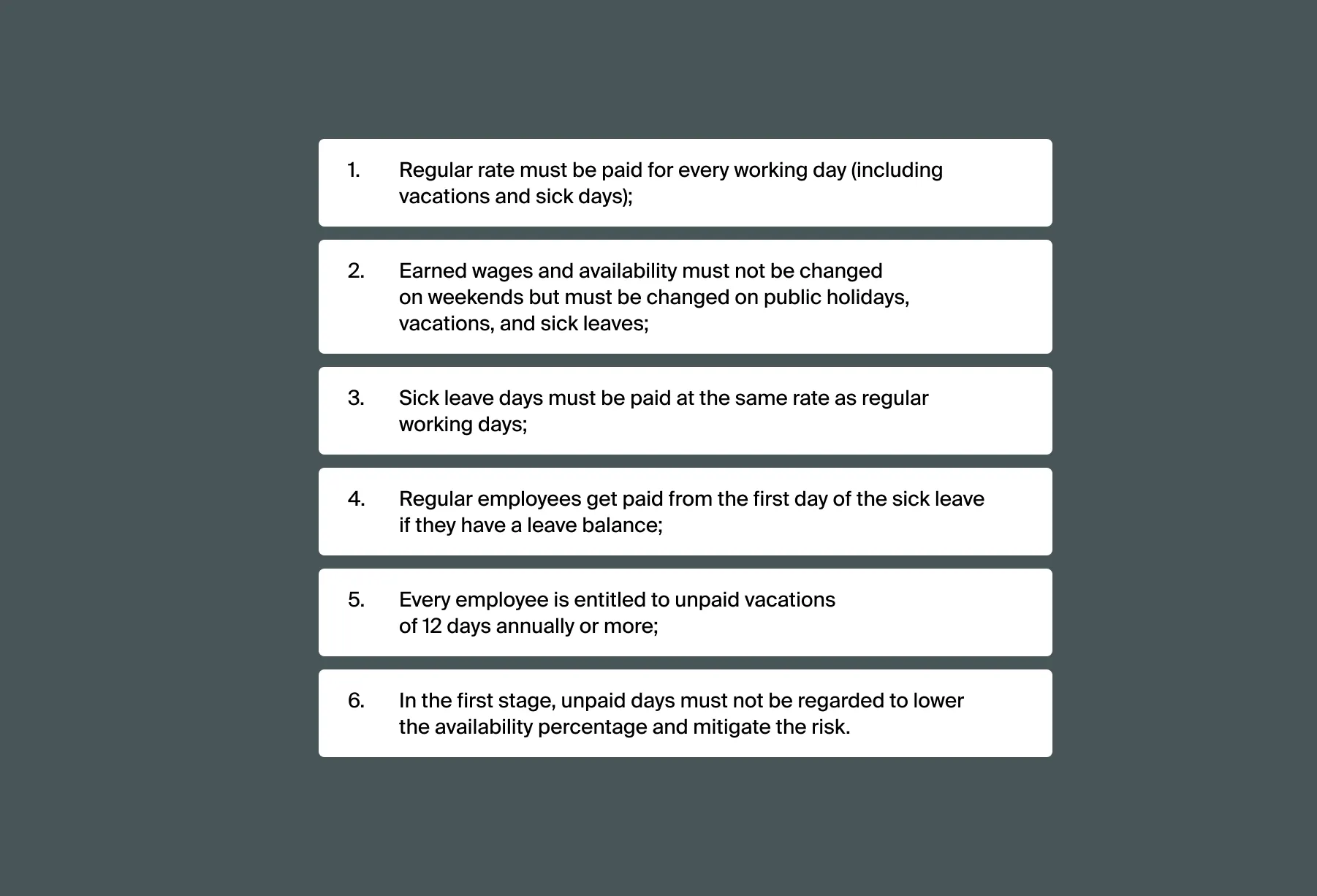

Main challenges

Workflow

In our collaboration with the client, we suggested and implemented some of the essential improvements:

- proposed a refined release process for the backend;

- introduced effective solutions for separate feature deployments;

- recognizing the importance of documentation, we recommended that QA create meeting notes to eliminate redundancies.

We have displayed proactive concern, addressing issues related to priorities, timelines, and the crucial yet unimplemented feature of multi-tenancy.

Besides, there was an urgency in addressing such challenges as integrating with the first real customer and implementing regular earned wage calculations. Yet, KITRUM adeptly works under time constraints, ensuring everything is completed efficiently and on time. We proposed optimal solutions and guided the client through the process, providing a smooth and successful collaboration.

Solution

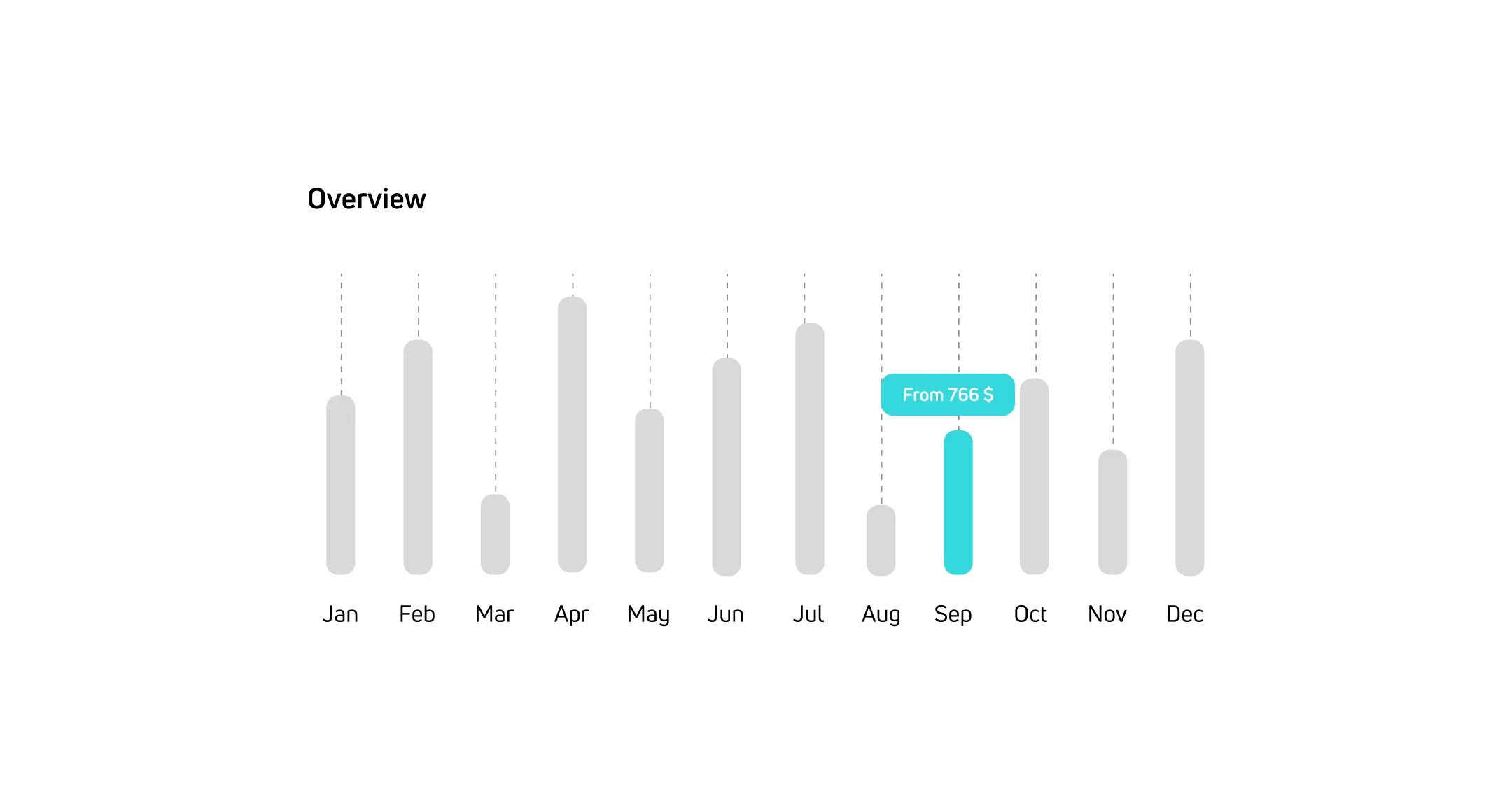

Results

Through our innovative solutions, the client secured a contract with the bank, marking a pivotal step towards going live. Our comprehensive approach brought the product to life and positioned it for success, ready to attract investors and customers.

Thanks to a great product and its continuous improvement multiplied by a successful marketing strategy, our client got investors, including MasterCard, Santander, Commerz Ventures Gruppe, Magma Venture Partners, SBI Group, Digital Leaders CQ, etc. The financial platform also received the Best FinTech Award at Efma, Best Mobile Banking Experience at the Bank Customer Experience Summit, First Place at Bank Innovation, and more.

This case fits one of KITRUM’s core principles: we at Kitrum provide tech solutions that align with our client’s business goals. This achievement highlights Kitrum’s commitment to delivering impactful results beyond development, empowering our clients to thrive in their ventures.