Bank

Global Banking crisis sparks concern: What’s at stake?

In a move that has sparked concerns about a global banking crisis, UBS has acquired Credit Suisse for €3 billion. This move comes on the heels of the collapse of US banks – Silvergate, SVB, Signature Bank, and Credit Suisse in less than two weeks.

Six central banks, including the Federal Reserve, European Central Bank, and Bank of England, have announced joint measures to inject financing into financial institutions to ease concerns.

Nouriel Roubini, an American economist, provided a detailed analysis of this measure in a tweet:

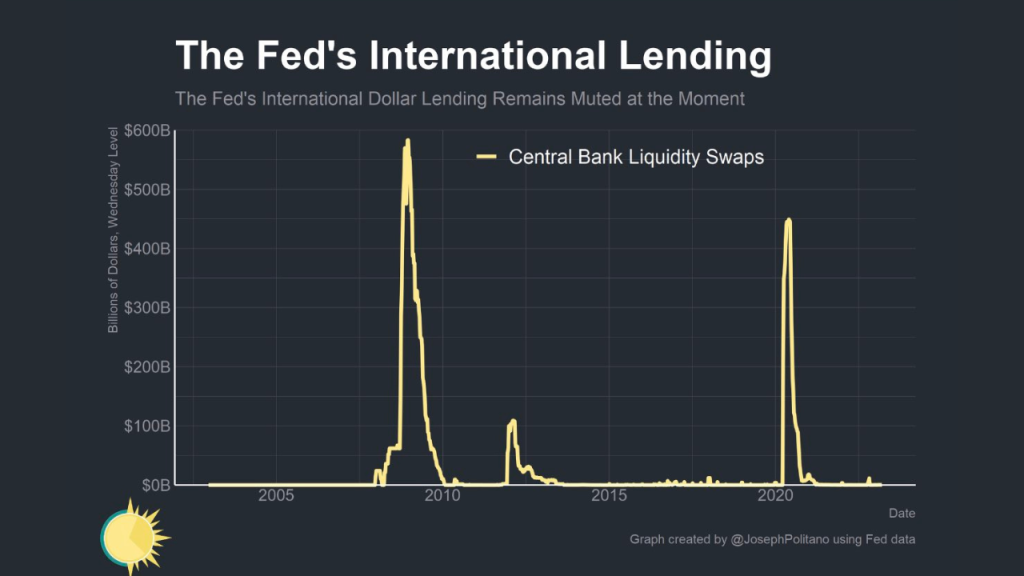

¨Use of Fed international swap lines spikes during severe risk-off episodes when there is a shortage of global dollar liquidity: GFC, EZ crisis, temper tantrum, Covid 3/20 shock. Expect another likely spike now. That is why the CBs coordinated action today¨

After years of low-cost loans, the worldwide interest rate surge has put borrowers in a difficult position. Investors are now watching two significant issues to see how the banking crisis will unfold.

- Credit Suisse has been required to reduce its Additional Tier 1 (AT1) debt to zero as part of the bailout deal. AT1 bonds are debt securities that convert to equity when a bank’s reserves fall below a certain level.

- The second issue is what the Federal Reserve will do with interest rates. As expected, the Fed raised the rate by 25 basis points to 5%. We see that inflation has slowed down slightly, but recent data indicates that inflationary pressure remains high.

Jerome Powell, the Chairman of the Federal Reserve, noted that their lending programs are effectively meeting the needs of banks and that all depositors’ savings are safe. However, he also highlighted that isolated banking problems, if left unresolved, can threaten the banking system.

The joint efforts of the Fed and other central banks could stop the increasing interest rates. However, there’s a lot of uncertainty surrounding the impact of inflation and high-interest rates on the global economy, and the last two weeks have seen a volatile market.

The situation still leaves many wondering just how severe the banking crisis is and what the future holds for financial institutions worldwide.

Technology

Silicon Valley’s efficiency drive: AI to potentially replace 200,000 laid-off tech workers

The recent massive layoffs in the tech industry, combined with the rapid development of AI, have raised questions about whether AI will replace human jobs and bring about significant changes to the workforce.

The recent announcement by Meta CEO Mark Zuckerberg that the company would be laying off 10,000 workers indicates this trend. Some CEOs have even claimed that many of these jobs were unnecessary and should never have been created.

Shortly after the Meta layoffs, OpenAI released GPT-4, the latest version of their powerful language model. It could replace some of the nearly 200,000 high-paying jobs lost in the tech industry.

However, given that even early versions of AI, like ChatGPT, are already capable of writing poetry, job applications, and developing websites, among other tasks, this forecast may be too optimistic.

TikTok vows to safeguard the personal data of American users, thwarting foreign access

On Thursday, TikTok’s CEO, Shou Zi Chew, will testify in front of the US Congress to address concerns about the company’s ties to China and potentially avoid a ban. TikTok has committed to protecting its US users’ data, including isolating their data to prevent access from China, which has been a significant concern for the company.

“There are more than 150 million Americans who use our platform, and we know that we have a responsibility to protect them,” — says Shou Zi Chew in the pre-appearance briefing document.

TikTok vows to protect underage users with content moderation amidst fears of a US ban or sale of ByteDance stake. TikTok’s CEO, Shou Zi Chew, announced the company’s commitment to preventing a total ban or sale of the Chinese parent company’s stake. One of the key measures is to ensure the safety of young users by moderating content that could be potentially dangerous, a move similar to other social networks. Currently, ByteDance controls 60% of TikTok’s shares, but the company’s founders hold the power to break any tie.

The US government has warned TikTok’s Chinese parent company, ByteDance, that they may consider selling their stake in the app or risk being banned in the country. Meanwhile, TikTok is weighing its options and contemplating cutting ties with ByteDance to continue operating globally.

Apps

AI mobile apps rake in over $14 million in revenue this year: Top 10 list

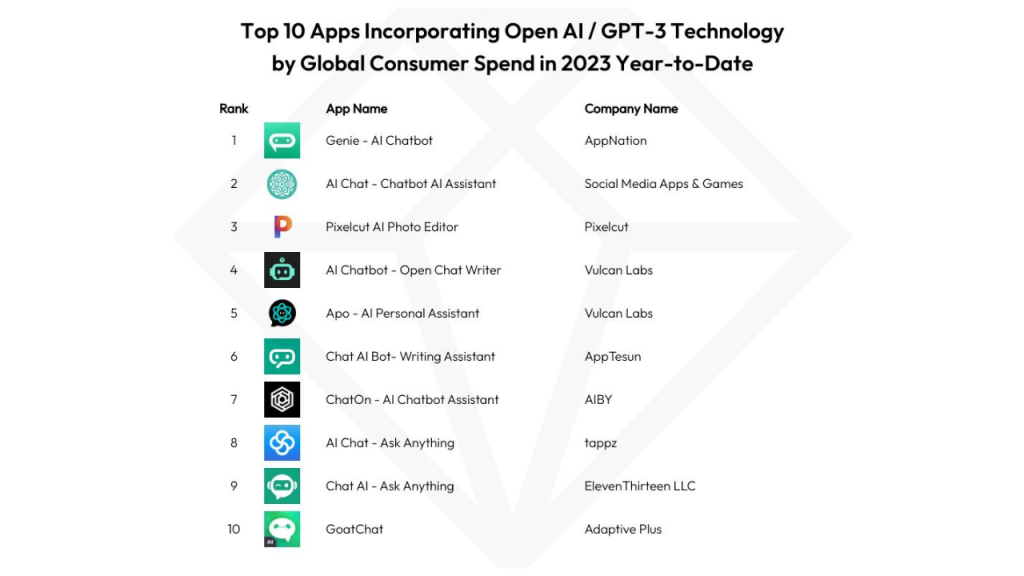

According to a recent analysis by data.ai, consumer demand for AI chatbot experiences has been driving millions of dollars into mobile apps that advertise their association with ChatGPT or OpenAI technologies, led by Mira Murati, CTO of Open.AI and her talented team.

The top 10 highest-earning apps alone generated over $14 million in global consumer spending in 2023, with Genie – AI Chatbot leading the way with $3.2 million in revenue. The apps’ income has been steadily increasing, with daily consumer spending averaging $232,000 in the first 20 days of March, up 11% from February’s average.