Major world events always reshape the interactions of companies with consumers and consumers with companies. In the heat of the moment, growth may seem lost and focus may seem lacking. However, this isn’t the time to lag behind or stop your normal due diligence with your FinTech data protection, security, and structural growth. All major crises come to an end. The tech world lives to fight another day and consumers will soon be banging at your door for more digital financial products. Instead of slowing down during a crisis, refocus and pivot to parts of your company that may be lacking. Take this time to focus on the security of your platform and applications, and protect your data. This way you can ensure that when your growth begins again you will be ready for anything including any cybersecurity threat.

Major FinTech Security Challenges

- Be Proactive Rather Than Reactive

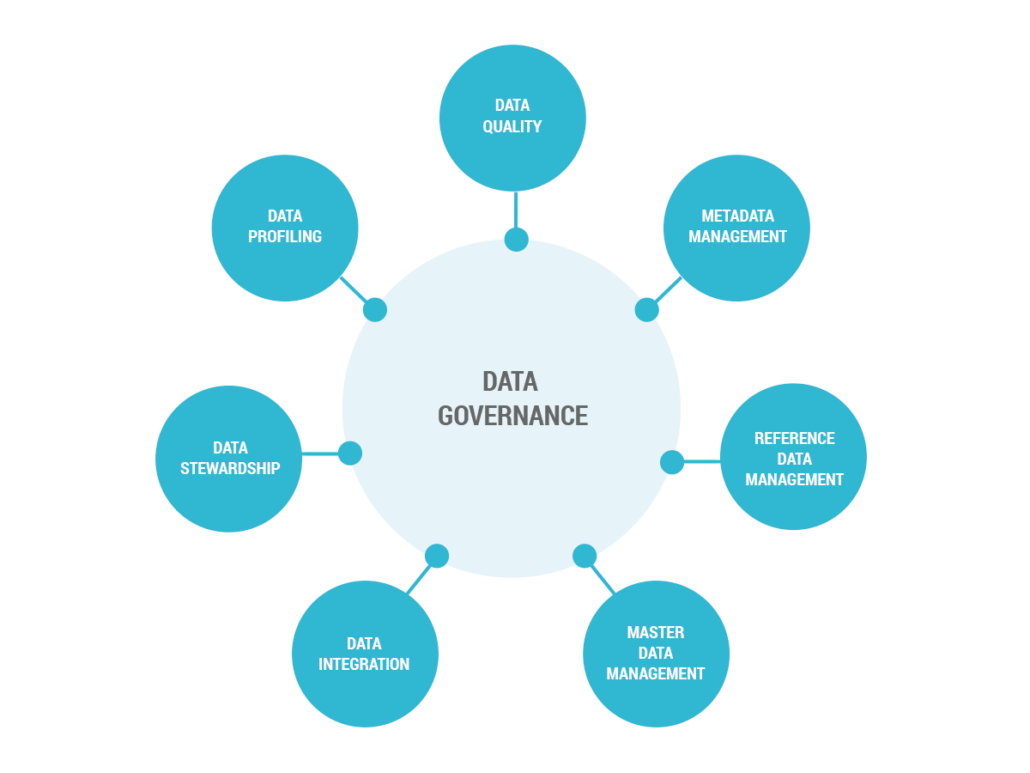

The most important lesson to learn from any data breach or security intrusion of any kind is that you need to be proactive in the protection of your assets. There is no place in the FinTech world for reactive companies. Reactive companies lose market share because they lose the faith of the consumer. Poor cybersecurity and Fintech data protection will cause you to lose trust. How is Equifax doing these days? Where should you be proactive? The following 4 major areas of critical importance are right below your nose. - Data Stewardship

When you are a steward of an asset you take ownership and responsibility for its wellbeing. You tend and care for it. As a data steward, you own your data and manage it well. Data that isn’t properly managed can easily be lost, forgotten about, incorrectly or never transmitted, or leaked to the public. Be proactive about the data you hold and understand the technical and legal aspects including hosting, maintaining, and destroying old retired data. FinTech developers can build strong systems to manage all of the data efficiently. - Securing Identities

It is 11 pm and someone is logging on to the corporate server. Do you know who it is? More and more entities in the FinTech world are moving to remote offices and remote resources. When you need to securely manage the work done from remote locations you need to ensure that the people behind those computers are actually the ones you’ve asked to work on the task. This could include geo-locations, one time passwords, or registered equipment. - Third-Party Components

If you lift the hood of your Volkswagen Golf GTI, how many parts does your favorite German car manufacturer make? There are probably a lot of parts made by third parties. The same goes for your FinTech digital assets. Don’t be surprised when you learn that you need to manage other companies’ tech when it is incorporated into your systems. A FinTech developer can make sure that there are no data leaks in third-party components. - Security Protocol Enforcement

Following General Data Protection Regulation (GDPR), Electronic Identification, Authentication, and Trust Services, or something similar, may feel like a pain but the cost of non-compliance after a lawsuit from an upset country will be an even harder pill to swallow. Every aspect of your FinTech startup needs to be delicately and proactively managed as if you were preparing for the worst. This absolutely includes making sure that all of the required security protocols are in place and all regulations, for your geographic location, are being followed. You want a lawyer to say to you that your actions and products are completely legally defensible. FinTech developers can ensure that your FinTech app/software has the most current security protocols

How To Protect Data In Your FinTech Startup

- Build Secure App Logic

When you are planning out the app, you need to handle each aspect of the process as if it is the absolute path for a breach, and then determine how to negate that breach. This could mean building 2-Factor authentication as default or forcing the use of complex passwords. It also means that you should ensure proper tokenization that allows servers to only store data that is crucial information. Each step of the user process should be logged. This way you can also review what went wrong and where in your app you should be focusing your attention. - Encrypt Sensitive Data

Having HTTPS or SSL on your website is just not good enough for FinTech. All information related to personal information, transaction information, or provided service information must be encrypted to the highest possible standard. The most trusted encryption type is Advanced Encryption Standard (AES) used by the US Federal Government. Other types are RSA, TDES, and ECC. - Code Logic Is The Key For Security

Anyone knows that the FinTech app starts and stops at the underlying code. If you don’t have an organized code then you most likely won’t have an organized app. Build a structure for your applications logically and in a way that a complete newbie can read and understand what is going on. Further, continually review, test, and improve constantly on what you have already done to ensure security and safety. Make sure to always look at the input validation, always check the data sent to external servers and networks, and flag what is sensitive data for the highest level of security. - Use Tokenization

You should only be storing information that is necessary to keep. If you don’t need the information of a certain type, like payment information, then it should be tokenized and removed from your data servers. Take a hint from Apple and most other major financial institutes that have begun standardizing one-time payment codes for security protection and efficient payments. Ensure that your tokenization is done right with the proper FinTech developer. - Integrate Security In Your Day-To-Day Workflows

Protect yourself against your employees. It isn’t that they are out to spread your secrets. However, there are always mistakes. Someone could inadvertently click on a bad link. Someone could be talking too loudly at a coffee shop about some backdoor. A contractor could be a little too disgruntled. Equipment goes missing all the time. Build up your internal defenses and keep everything tight. - Prepare An Authentication & Authorization System

Not anyone should be let into the system and not everyone in the system should be allowed to do anything they want. There are obvious restrictions on admittance and allowed actions. You need to secure exactly what each registered individual’s role is as part of the whole. You need to make sure that there is a clear, stable, and secure path for identification, authentication, and authorization. An individual needs to authenticate their ID before being allowed onto the network and that individual is limited based on their authorized access. A safe and secure Authentication & Authorization System will keep everyone in that needs to be in and no one else.

Outsourcing FinTech App Development

Do you have in-house experts in FinTech Field?

Of all of the topics discussed how many experts in your company can you confidently say could handle these issues? Are some of the issues still issues? That is okay. Honestly it is normal. Most FinTech companies are not going to have all of the required in-house talents to ensure that every FinTech data protect protocol is followed and the cybersecurity method is current. You will need to outsource the gaps to get them filled and secure. The moment you choose not to secure a potential breach is a moment someone else will take advantage of it.

Do you have Security Experts?

FinTech developers are not all security experts. Though they are amazingly intelligent, and talented at certain processes and tools, you need to rely on security experts that work in this field on a daily basis. This means potentially going outside the company for help. If you would prefer not to do that, do you think you could afford not to if there was a security breach or cybersecurity issue? If you have comments, questions, or concerns and need expert advice please feel free to reach out to any of our trained security experts and tech developers at KitRUM. We are here to help you will all of your remote developer needs. Recently KitRUM has been recognized among the Top Fintech Software Development Companies of 2020.