It wasn’t long ago that the mention of artificial intelligence was a term only used in science fiction. Behind the scenes, however, some of the world’s most industrious people were setting the stage for reality. We are surrounded by AI and other tech intended to make our lives more convenient and it keeps getting better. Businesses have exploded with advancements in software and engineering, and machine learning and AI are also making significant inroads in the financial services industry. In fact, $5.6 billion is expected to be spent by the industry on AI solutions by 2020.

In case you still don’t quite have a handle on what artificial intelligence is, we describe it as an intelligent software used in technology to replace an action previously done by a human. Infinite data is continually uploaded into the systems the AI runs on, completely erasing any possibility for error. It’s a human, but millions of times smarter and quicker than we could ever fathom of being.

Machine learning is based on the theory that a computer can teach itself new data through the use of algorithms, statistics, and pattern recognition. The idea isn’t new knowledge, but in the past decade machine learning has taken on completely new energy. The more data you can feed to the system, the smarter the intelligence will get – which is perfect for the financial sector; there are millions of data being stored on customers, accounts, etc.

Why should financial companies care?

Regardless of the incredible uses of AI and machine learning, the financial sector continues to gain pushback from many in the business. There are issues involving data security, the cost of executing AI into their business, and the current shortage of specialized DS/ML engineers. Financial companies that do implement the tech into their company, however, put themselves at an advantage by the increased revenue they receive thanks to lower operational costs and higher productivity.

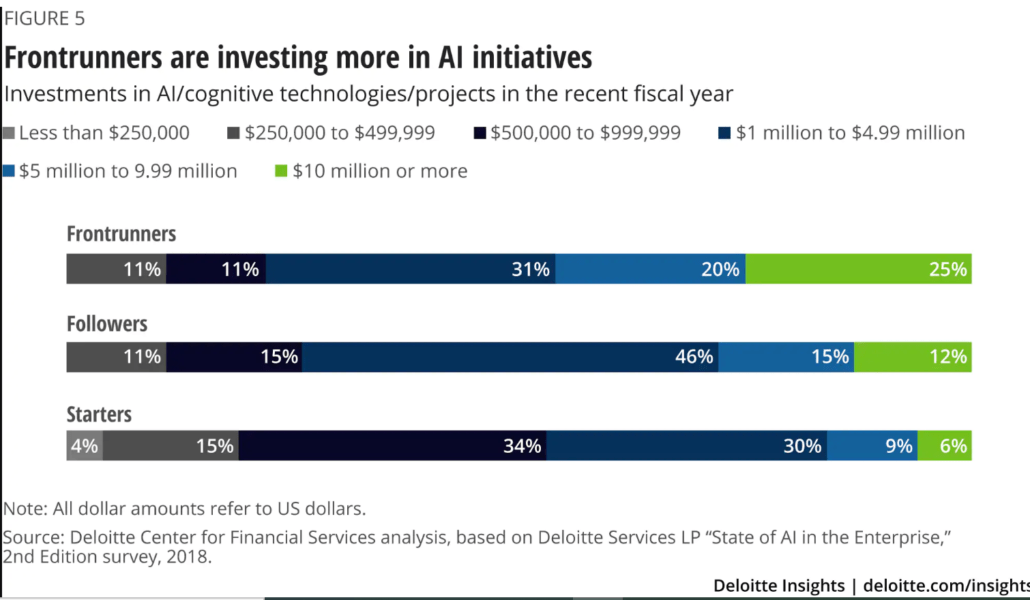

Deloitte studied 206 US financial company’s managers to improve knowledge of how and why their businesses are adopting artificial intelligence and the result AI is possessing on their market. And one of the most interesting insides is that frontrunners are financing in AI much profoundly than different sections, while also expediting their spending at a larger scale.

Almost 50% of the frontrunners examined had spent more than US $5 million in AI operations. And almost 70% going to increase this amount of money in the next fiscal period.

What solutions can we implement with AI and machine learning?

We use AI in our financial activities each and every day. Every time we deposit a cheque or pay for our coffee with ApplePay, the articulate workings of artificial intelligence are ensuring everything is done accurately, quickly, and safely. Software developers have applied this technology within many inner-workings of the financial sector. Applying for financial services, such as insurance, a credit card, or even a mortgage can be decided in seconds, with AI software that creates a report and predicts your credit – making an instant decision. We can even build an auto or house insurance policy without ever needing to speak to a human. And, through machine learning, identify theft/fraud can be detected and prevented instantly. Honestly, we’ve only just begun to see what we can do.

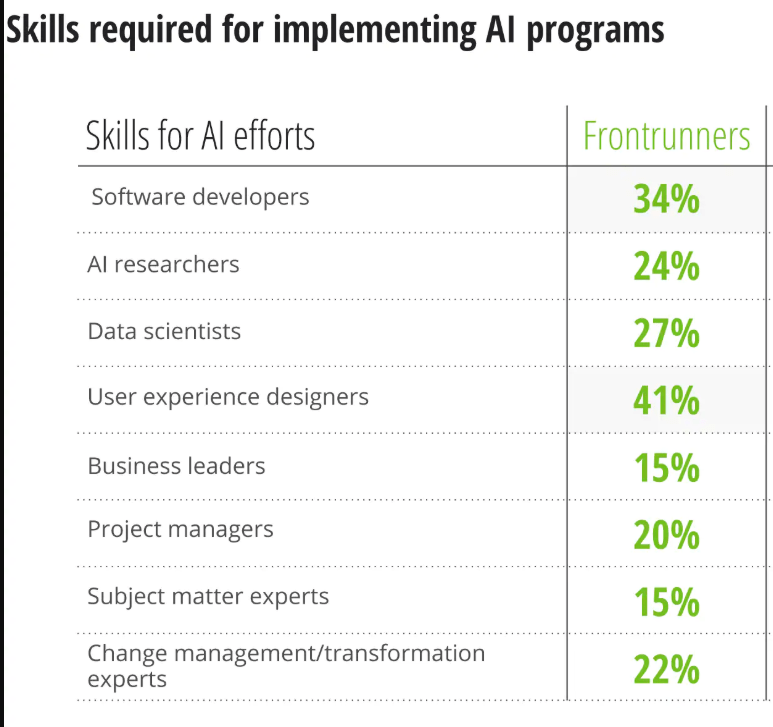

The growth of artificial intelligence in the financial business shows how fast it’s transforming the industry environment also in traditionalistic sectors. Also, a pretty interesting statistic that shows a lack of specific experience demanded to create and deploy AI accomplishment — specifically, software developers and user experience designers.

Source: Diolette survey

The success of a machine learning project depends more on building efficient infrastructure, collecting suitable datasets, and applying the right algorithms. Our dev team at KitRUM has extensive experience in implementing ML and AI solutions.